-

Capital City Bank Group, Inc. Reports First Quarter 2023 Results

المصدر: Nasdaq GlobeNewswire / 24 أبريل 2023 07:00:01 America/New_York

TALLAHASSEE, Fla., April 24, 2023 (GLOBE NEWSWIRE) -- Capital City Bank Group, Inc. (NASDAQ: CCBG) today reported net income attributable to common shareowners of $15.0 million, or $0.88 per diluted share, for the first quarter of 2023 compared to $11.7 million, or $0.68 per diluted share, for the fourth quarter of 2022, and $8.5 million, or $0.50 per diluted share, for the first quarter of 2022.

QUARTER HIGHLIGHTS (1st Quarter 2023 versus 4th Quarter 2022)

- Strong growth in net interest income of 6% - net interest margin percentage grew 28 basis points to 4.04% - deposit interest expense was well controlled at 26 basis points (total deposits) and 46 basis points (interest bearing deposits)

- Loan growth of $143 million, or 5.9% (average) and $112 million, or 4.4% (end of period)

- Average quarterly deposit growth of $14 million, or 0.4%, and a decline of $115 million, or 2.9%, in period end balance, which reflected a normal seasonal reduction of $88 million in public fund balances

- Continued strong credit quality metrics – allowance coverage ratio increased to 1.01%

- Noninterest income increased $1.3 million, or 6.1%, due to higher mortgage banking revenues at Capital City Home Loans (“CCHL”)

- Noninterest expense decreased $1.8 million, or 4.3%, and reflected no pension settlement expense for the quarter compared to $1.8 million for the prior quarter – expenses (excluding pension settlement expense) were favorably impacted by a $1.8 million gain from the sale of a banking office that was offset by higher payroll taxes (annual re-set), performance-based compensation, and the addition of two new offices during the first quarter

- Tangible book value per share increased $1.00, or 5.7%, primarily due to strong earnings and a favorable valuation adjustment for available for sale securities

“The strength and flexibility of our balance sheet – particularly the diversity and granularity of our core deposit franchise – was evident during a volatile quarter for the industry,” said William G. Smith, Jr., Chairman, President, and CEO of Capital City Bank Group. “Continued margin expansion and loan growth were the primary drivers of our strong performance, which resulted in tangible book value per share growth of 5.7%. While there remains uncertainty around the possibility of a near-term recession or economic slowing, I feel good about our positioning and optimistic about our full-year performance.”

Discussion of Operating Results

Net Interest Income/Net Interest Margin

Tax-equivalent net interest income for the first quarter of 2023 totaled $40.5 million, compared to $38.2 million for the fourth quarter of 2022, and $24.8 million for the first quarter of 2022. Compared to both prior periods, the increase reflected strong loan growth and higher interest rates across a majority of our earning assets, partially offset by higher deposit costs.

Our net interest margin for the first quarter of 2023 was 4.04%, an increase of 28 basis points over the fourth quarter of 2022 and 149 basis points over the first quarter of 2022, both driven by higher interest rates and an overall improved earning asset mix. For the first quarter of 2023, our cost of funds was 35 basis points, an increase of four basis points over the fourth quarter of 2022 and 27 basis points over the first quarter of 2022. Our cost of interest-bearing deposits was 46 basis points, 35 basis points, and 4 basis points, respectively, for the same periods. Our total cost of deposits (including noninterest bearing accounts) was 26 basis points, 20 basis points, and 2 basis points, respectively, for the same periods.

Provision for Credit Losses

We recorded a provision for credit losses of $3.1 million for the first quarter of 2023 compared to $3.5 million for the fourth quarter of 2022 and no provision for the first quarter of 2022. The decrease in the provision compared to the fourth quarter of 2022 was primarily attributable to a lower level of loan growth. The credit loss provision for the first quarter of 2022 generally reflected lower required reserves needed post-pandemic. We discuss the allowance for credit losses further below.

Noninterest Income and Noninterest Expense

Noninterest income for the first quarter of 2023 totaled $22.2 million compared to $21.0 million for the fourth quarter of 2022 and $25.8 million for the first quarter of 2022. The $1.2 million increase over the fourth quarter of 2022 was primarily attributable to higher mortgage banking revenues at CCHL of $1.5 million partially offset by lower deposit fees $0.3 million. The increase in mortgage banking revenues reflected a higher level of rate locks and gain on sale margin. The decrease in deposit fees was partially attributable to two less processing days in the first quarter. Compared to the first quarter of 2022, the $3.6 million decrease reflected lower wealth management fees of $2.1 million and mortgage banking revenues of $1.9 million, partially offset by higher other income of $0.5 million. The decrease in wealth management fees was due to lower insurance commission revenues which reflected higher than normal revenues in the first quarter of 2022 related to the closing of several large insurance policies. The decline in mortgage banking revenues was attributable to a lower level of rate locks and gain on sale margin. Additional information on our mortgage banking operation is provided in our first quarter investor presentation. The increase in other income was primarily due to higher loan servicing income and miscellaneous income.

Noninterest expense for the first quarter of 2023 totaled $40.5 million compared to $42.3 million for the fourth quarter of 2022 and $39.2 million for the first quarter of 2022. Compared to the fourth quarter of 2022, the $1.8 million decrease reflected lower other expense of $2.4 million that was partially offset by an increase in occupancy expense of $0.5 million and compensation expense of $0.1 million. The reduction in other expense reflected lower other real estate expense of $1.6 million which was due to a $1.8 million gain from the sale of a banking office. Further, pension expense (non-service-related component) for the first quarter of 2023 totaled $0.2 million compared to $1.1 million for the fourth quarter of 2022 which included a $1.8 million pension settlement charge. The increase in occupancy expense reflected higher expenses related to three recently opened full-service offices and the re-location of one office. The slight increase in compensation expense reflected an increase in salary expense of $0.5 million due to higher payroll taxes (annual re-set) that was partially offset by a decrease in associate benefit expense of $0.4 million due to lower pension plan service cost. Compared to the first quarter of 2022, the $1.3 million increase reflected increases in compensation expense of $0.8 million and occupancy expense of $0.7 million that were partially off by a decrease in other expense of $0.2 million. The increase in compensation expense reflected an increase of $1.0 million in salary expense that was partially offset by a $0.2 million decrease in associate benefit expense. The addition of banking offices and staffing in new markets drove the variance in salary and occupancy expenses. The decrease in associate benefit expense was primarily due to a decrease in pension service cost of $0.7 million that was partially offset by an increase in stock-based compensation expense of $0.4 million.

Income Taxes

We realized income tax expense of $4.1 million (effective rate of 21.7%) for the first quarter of 2023 compared to $2.6 million (effective rate of 19.6%) for the fourth quarter of 2022 and $2.2 million (effective rate of 19.8%) for the first quarter of 2022. A discrete tax item of $0.4 million related our SERP plan favorably impacted the effective tax rate for the fourth quarter of 2022. Absent discrete items, we expect our annual effective tax rate to approximate 21%-22% in 2023. The increase in the effective tax rate for 2023 reflects a lower level of pre-tax income from CCHL in relation to our consolidated income as the non-controlling interest adjustment for CCHL is accounted for as a permanent tax adjustment.

Discussion of Financial Condition

Earning Assets

Average earning assets totaled $4.063 billion for the first quarter of 2023, an increase of $30.0 million, or 0.7%, over the fourth quarter of 2022, and an increase of $123.9 million, or 3.1%, over the first quarter of 2022. The increase over both prior periods was primarily driven by higher deposit balances (see below – Funding). The mix of earning assets continues to improve driven by strong loan growth.

Average loans held for investment (“HFI”) increased $143.0 million, or 5.9%, over the fourth quarter of 2022 and $618.8 million, or 31.5%, over the first quarter of 2022. Period end loans increased $111.7 million, or 4.4%, over the fourth quarter of 2022 and $651.4 million, or 32.8%, over the first quarter of 2022. Compared to the fourth quarter of 2022, a majority of the increase was realized in the residential real estate category, and to a lesser extent, the construction and commercial real estate mortgage categories. Compared to the first quarter of 2022, loan growth was broad based, with increases realized in all categories except consumer loans.

Allowance for Credit Losses

At March 31, 2023, the allowance for credit losses for HFI loans totaled $26.5 million compared to $24.7 million at December 31, 2022 and $20.8 million at March 31, 2022. Activity within the allowance is provided on Page 9. The increase in the allowance was driven primarily by loan growth. At March 31, 2023, the allowance represented 1.01% of HFI loans compared to 0.98% at December 31, 2022, and 1.05% at March 31, 2022.

Credit Quality

Overall credit quality remains stable. Nonperforming assets (nonaccrual loans and other real estate) totaled $4.6 million at March 31, 2023 compared to $2.7 million at December 31, 2022 and $2.7 million at March 31, 2022. At March 31, 2023, the increase was primarily due to the addition of one large business loan relationship totaling $1.8 million to nonaccrual status – it is in the process of collection and is adequately secured and reserved for. At March 31, 2023, nonperforming assets as a percent of total assets equaled 0.10%, compared to 0.06% at December 31, 2022 and 0.06% at March 31, 2022. Nonaccrual loans totaled $4.6 million at March 31, 2023, a $2.3 million increase over December 31, 2022 and a $1.9 million increase over March 31, 2022. Further, classified loans totaled $12.2 million at March 31, 2023, a $7.2 million decrease from December 31, 2022 and a $10.2 million decrease from March 31, 2022.

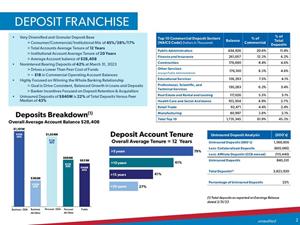

Deposits

Average total deposits were $3.817 billion for the first quarter of 2023, an increase of $14.3 million, or 0.4%, over the fourth quarter of 2022 and $103.3 million, or 2.8%, over the first quarter of 2022. Compared to the fourth quarter of 2022, the increase reflected higher NOW account balances, primarily due to a seasonal increase in our public fund deposits that occurred late in the fourth quarter of 2022. Compared to the first quarter of 2022, we experienced strong growth in our NOW accounts, and to a lesser degree, our savings accounts.

Period end total deposits declined $115.4 million from the fourth quarter of 2022, and reflected lower balances in noninterest bearing accounts, NOW accounts, and savings accounts, partially offset by slight growth in money market accounts and certificates of deposit. The $52.2 million decline in noninterest bearing accounts was largely due to the migration of two large commercial clients to an interest-bearing NOW account, in addition to clients seeking a higher yielding investment account at Capital City Investments (approximately $30 million, predominantly higher balance clients). The $47.8 million decline in the NOW account balance was largely driven by an anticipated seasonal decline in public fund balances of $66 million, partially offset by the previously mentioned migration of two clients from noninterest bearing accounts. The $20.1 million decline in the savings account balance was primarily attributable to clients seeking higher yielding investment products outside the Bank. The $4.5 million increase in the money market account balance occurred also due to some migration from noninterest bearing accounts, in addition to growth in our new markets which offered a promotional rate. We continue to closely monitor our cost of deposits and deposit mix as we manage through this rising rate environment. Additional information on the profile of our deposit base is provided in a supplement (Exhibit 99.2) to this release.

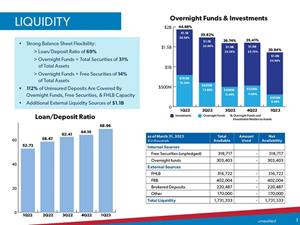

Liquidity

The Bank maintained an average net overnight funds (deposits with banks plus FED funds sold less FED funds purchased) sold position of $361.0 million in the first quarter of 2023 compared to $469.4 million in the fourth quarter of 2022. The declining overnight funds position reflected growth in average loans.

At March 31, 2023, we had the ability to generate approximately $1.428 billion (excludes overnight funds position of $303 million) in additional liquidity through various sources including various federal funds purchased lines, Federal Home Loan Bank borrowings, the Federal Reserve Discount Window, and through brokered deposits.

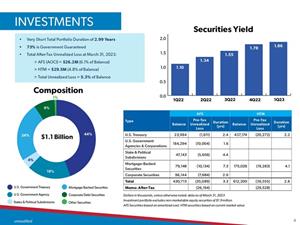

We also view our investment portfolio as a liquidity source and have the option to pledge securities in our portfolio as collateral for borrowings or deposits, and/or to sell selected securities. Our portfolio consists of debt issued by the U.S. Treasury, U.S. governmental agencies, municipal governments, and corporate entities. At March 31, 2023, the weighted-average maturity and duration of our portfolio were 3.34 years and 2.99 years, respectively, and the available-for-sale portfolio had a net unrealized pre-tax loss of $35.0 million.

Additional information on our liquidity and investment portfolio is included in a supplement (Exhibit 99.2) to this release.

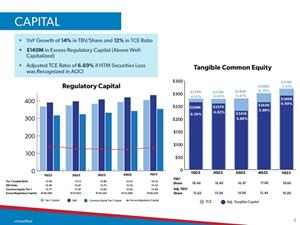

Capital

Shareowners’ equity was $411.2 million at March 31, 2023 compared to $394.0 million at December 31, 2022 and $372.1 million at March 31, 2022. For the first three months of 2023, shareowners’ equity was positively impacted by net income attributable to common shareowners of $15.0 million, a $5.6 million decrease in the unrealized loss on investment securities, the issuance of stock of $1.8 million, and stock compensation accretion of $0.5 million. Shareowners’ equity was reduced by common stock dividends of $3.1 million ($0.18 per share), the repurchase of stock of $0.8 million (25,000 shares), net adjustments totaling $1.2 million related to transactions under our stock compensation plans, and a $0.6 million decrease in the fair value of the interest rate swap related to subordinated debt.

At March 31, 2023, our total risk-based capital ratio was 15.53% compared to 15.52% at December 31, 2022 and 16.98% at March 31, 2022. Our common equity tier 1 capital ratio was 12.68%, 12.64%, and 13.77%, respectively, on these dates. Our leverage ratio was 9.28%, 9.06%, and 8.78%, respectively, on these dates. At March 31, 2023, all our regulatory capital ratios exceeded the threshold to be designated as “well-capitalized” under the Basel III capital standards. Further, our tangible common equity ratio was 7.37% at March 31, 2023 compared to 6.79% and 6.61% at December 31, 2022 and March 31, 2022, respectively. If our unrealized HTM securities losses of $29.5 million (after-tax) were recognized in accumulated other comprehensive loss, our adjusted tangible capital ratio would be 6.69%.

About Capital City Bank Group, Inc.

Capital City Bank Group, Inc. (NASDAQ: CCBG) is one of the largest publicly traded financial holding companies headquartered in Florida and has approximately $4.4 billion in assets. We provide a full range of banking services, including traditional deposit and credit services, mortgage banking, asset management, trust, merchant services, bankcards, securities brokerage services and financial advisory services, including the sale of life insurance, risk management and asset protection services. Our bank subsidiary, Capital City Bank, was founded in 1895 and now has 58 banking offices and 101 ATMs/ITMs in Florida, Georgia and Alabama. For more information about Capital City Bank Group, Inc., visit www.ccbg.com.

FORWARD-LOOKING STATEMENTS

Forward-looking statements in this Press Release are based on current plans and expectations that are subject to uncertainties and risks, which could cause our future results to differ materially. The words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “intend,” “plan,” “target,” “vision,” “goal,” and similar expressions are intended to identify forward-looking statements. The following factors, among others, could cause our actual results to differ: our ability to successfully manage credit risk, interest rate risk, liquidity risk, and other risks inherent to our industry; legislative or regulatory changes; adverse developments in the financial services industry generally, such as the recent bank failures and any related impact on depositor behavior; the effects of changes in the level of checking or savings account deposits and the competition for deposits on our funding costs, net interest margin and ability to replace maturing deposits and advances, as necessary; the effects of actions taken by governmental agencies to stabilize the financial system and the effectiveness of such actions; changes in monetary and fiscal policies of the U.S. Government; inflation, interest rate, market and monetary fluctuations; the effects of security breaches and computer viruses that may affect our computer systems or fraud related to debit card products; the accuracy of our financial statement estimates and assumptions, including the estimates used for our allowance for credit losses, deferred tax asset valuation and pension plan; changes in our liquidity position; changes in accounting principles, policies, practices or guidelines; the frequency and magnitude of foreclosure of our loans; the effects of our lack of a diversified loan portfolio, including the risks of loan segments, geographic and industry concentrations; the strength of the United States economy in general and the strength of the local economies in which we conduct operations; our ability to declare and pay dividends, the payment of which is subject to our capital requirements; changes in the securities and real estate markets; structural changes in the markets for origination, sale and servicing of residential mortgages; uncertainty in the pricing of residential mortgage loans that we sell, as well as competition for the mortgage servicing rights related to these loans and related interest rate risk or price risk resulting from retaining mortgage servicing rights and the potential effects of higher interest rates on our loan origination volumes; the effect of corporate restructuring, acquisitions or dispositions, including the actual restructuring and other related charges and the failure to achieve the expected gains, revenue growth or expense savings from such corporate restructuring, acquisitions or dispositions; the effects of natural disasters, harsh weather conditions (including hurricanes), widespread health emergencies (including pandemics, such as the COVID-19 pandemic), military conflict, terrorism, civil unrest or other geopolitical events; our ability to comply with the extensive laws and regulations to which we are subject, including the laws for each jurisdiction where we operate; the willingness of clients to accept third-party products and services rather than our products and services and vice versa; increased competition and its effect on pricing; technological changes; the outcomes of litigation or regulatory proceedings; negative publicity and the impact on our reputation; changes in consumer spending and saving habits; growth and profitability of our noninterest income; the limited trading activity of our common stock; the concentration of ownership of our common stock; anti-takeover provisions under federal and state law as well as our Articles of Incorporation and our Bylaws; other risks described from time to time in our filings with the Securities and Exchange Commission; and our ability to manage the risks involved in the foregoing. Additional factors can be found in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and our other filings with the SEC, which are available at the SEC’s internet site (http://www.sec.gov). Forward-looking statements in this Press Release speak only as of the date of the Press Release, and we assume no obligation to update forward-looking statements or the reasons why actual results could differ.

USE OF NON-GAAP FINANCIAL MEASURES

UnauditedWe present a tangible common equity ratio and a tangible book value per diluted share that removes the effect of goodwill and other intangibles resulting from merger and acquisition activity. We believe these measures are useful to investors because it allows investors to more easily compare our capital adequacy to other companies in the industry.

The GAAP to non-GAAP reconciliations are provided below.

(Dollars in Thousands, except per share data) Mar 31, 2023 Dec 31, 2022 Sep 30, 2022 Jun 30, 2022 Mar 31, 2022 Shareowners' Equity (GAAP) $ 411,240 $ 394,016 $ 373,165 $ 371,675 $ 372,145 Less: Goodwill and Other Intangibles (GAAP) 93,053 93,093 93,133 93,173 93,213 Tangible Shareowners' Equity (non-GAAP) A 318,187 300,923 280,032 278,502 278,932 Total Assets (GAAP) 4,409,742 4,525,958 4,332,671 4,354,297 4,310,045 Less: Goodwill and Other Intangibles (GAAP) 93,053 93,093 93,133 93,173 93,213 Tangible Assets (non-GAAP) B $ 4,316,689 $ 4,432,865 $ 4,239,538 $ 4,261,124 $ 4,216,832 Tangible Common Equity Ratio (non-GAAP) A/B 7.37 % 6.79 % 6.61 % 6.54 % 6.61 % Actual Diluted Shares Outstanding (GAAP) C 17,049,913 17,039,401 16,998,177 16,981,614 16,962,362 Tangible Book Value per Diluted Share (non-GAAP) A/C $ 18.66 $ 17.66 $ 16.47 $ 16.40 $ 16.44 CAPITAL CITY BANK GROUP, INC. EARNINGS HIGHLIGHTS Unaudited Three Months Ended (Dollars in thousands, except per share data) Mar 31, 2023 Dec 31, 2022 Mar 31, 2022 EARNINGS Net Income Attributable to Common Shareowners $ 14,954 $ 11,664 $ 8,455 Diluted Net Income Per Share $ 0.88 $ 0.68 $ 0.50 PERFORMANCE Return on Average Assets 1.37 % 1.06 % 0.80 % Return on Average Equity 15.01 12.16 8.93 Net Interest Margin 4.04 3.76 2.55 Noninterest Income as % of Operating Revenue 35.52 35.50 51.11 Efficiency Ratio 64.48 % 71.47 % 77.55 % CAPITAL ADEQUACY Tier 1 Capital 14.51 % 14.53 % 15.98 % Total Capital 15.53 15.52 16.98 Leverage 9.28 9.06 8.78 Common Equity Tier 1 12.68 12.64 13.77 Tangible Common Equity(1) 7.37 6.79 6.61 Equity to Assets 9.33 % 8.71 % 8.63 % ASSET QUALITY Allowance as % of Non-Performing Loans 577.63 % 1,076.89 % 760.83 % Allowance as a % of Loans HFI 1.01 0.98 1.05 Net Charge-Offs as % of Average Loans HFI 0.24 0.21 0.16 Nonperforming Assets as % of Loans HFI and OREO 0.17 0.11 0.14 Nonperforming Assets as % of Total Assets 0.10 % 0.06 % 0.06 % STOCK PERFORMANCE High $ 36.86 $ 36.23 $ 28.88 Low 28.18 31.14 25.96 Close $ 29.31 $ 32.50 $ 26.36 Average Daily Trading Volume 41,737 31,894 24,019 (1)Tangible common equity ratio is a non-GAAP financial measure. For additional information, including a reconciliation to GAAP, refer to Page 5. CAPITAL CITY BANK GROUP, INC. CONSOLIDATED STATEMENT OF FINANCIAL CONDITION Unaudited 2023 2022 (Dollars in thousands) First Quarter Fourth Quarter Third Quarter Second Quarter First Quarter ASSETS Cash and Due From Banks $ 84,549 $ 72,114 $ 72,686 $ 91,209 $ 77,963 Funds Sold and Interest Bearing Deposits 303,403 528,536 497,679 603,315 790,465 Total Cash and Cash Equivalents 387,952 600,650 570,365 694,524 868,428 Investment Securities Available for Sale 402,943 413,294 416,745 601,405 624,361 Investment Securities Held to Maturity 651,755 660,744 676,178 528,258 518,678 Other Equity Securities 1,883 10 1,349 900 855 Total Investment Securities 1,056,581 1,074,048 1,094,272 1,130,563 1,143,894 Loans Held for Sale 55,118 54,635 50,304 48,708 50,815 Loans Held for Investment ("HFI"): Commercial, Financial, & Agricultural 236,263 247,362 246,304 247,902 230,213 Real Estate - Construction 253,903 234,519 237,718 225,664 174,293 Real Estate - Commercial 798,438 782,557 715,870 699,093 669,110 Real Estate - Residential 827,124 721,759 573,963 478,121 368,020 Real Estate - Home Equity 207,241 208,120 202,512 194,658 188,174 Consumer 305,324 324,450 347,949 359,906 347,785 Other Loans 7,660 5,346 20,822 6,854 6,692 Overdrafts 931 1,067 1,047 1,455 1,222 Total Loans Held for Investment 2,636,884 2,525,180 2,346,185 2,213,653 1,985,509 Allowance for Credit Losses (26,507 ) (24,736 ) (22,510 ) (21,281 ) (20,756 ) Loans Held for Investment, Net 2,610,377 2,500,444 2,323,675 2,192,372 1,964,753 Premises and Equipment, Net 82,055 82,138 81,736 82,932 82,518 Goodwill and Other Intangibles 93,053 93,093 93,133 93,173 93,213 Other Real Estate Owned 13 431 13 90 17 Other Assets 124,593 120,519 119,173 111,935 106,407 Total Other Assets 299,714 296,181 294,055 288,130 282,155 Total Assets $ 4,409,742 $ 4,525,958 $ 4,332,671 $ 4,354,297 $ 4,310,045 LIABILITIES Deposits: Noninterest Bearing Deposits $ 1,601,388 $ 1,653,620 $ 1,737,046 $ 1,724,671 $ 1,704,329 NOW Accounts 1,242,721 1,290,494 990,021 1,036,757 1,062,498 Money Market Accounts 271,880 267,383 292,932 289,337 288,877 Savings Accounts 617,310 637,374 646,526 639,594 614,599 Certificates of Deposit 90,621 90,446 92,853 95,899 95,204 Total Deposits 3,823,920 3,939,317 3,759,378 3,786,258 3,765,507 Short-Term Borrowings 26,632 56,793 52,271 39,463 30,865 Subordinated Notes Payable 52,887 52,887 52,887 52,887 52,887 Other Long-Term Borrowings 463 513 562 612 806 Other Liabilities 85,878 73,675 84,657 93,319 77,323 Total Liabilities 3,989,780 4,123,185 3,949,755 3,972,539 3,927,388 Temporary Equity 8,722 8,757 9,751 10,083 10,512 SHAREOWNERS' EQUITY Common Stock 170 170 170 170 169 Additional Paid-In Capital 37,512 37,331 36,234 35,738 35,188 Retained Earnings 405,634 393,744 384,964 376,532 370,531 Accumulated Other Comprehensive Loss, Net of Tax (32,076 ) (37,229 ) (48,203 ) (40,765 ) (33,743 ) Total Shareowners' Equity 411,240 394,016 373,165 371,675 372,145 Total Liabilities, Temporary Equity and Shareowners' Equity $ 4,409,742 $ 4,525,958 $ 4,332,671 $ 4,354,297 $ 4,310,045 OTHER BALANCE SHEET DATA Earning Assets $ 4,051,987 $ 4,182,399 $ 3,988,440 $ 3,996,238 $ 3,970,684 Interest Bearing Liabilities 2,302,514 2,395,890 2,128,052 2,154,549 2,145,736 Book Value Per Diluted Share $ 24.12 $ 23.12 $ 21.95 $ 21.89 $ 21.94 Tangible Book Value Per Diluted Share(1) 18.66 17.66 16.47 16.40 16.44 Actual Basic Shares Outstanding 17,022 16,987 16,962 16,959 16,948 Actual Diluted Shares Outstanding 17,050 17,039 16,998 16,982 16,962 (1) Tangible book value per diluted share is a non-GAAP financial measure. For additional information, including a reconciliation to GAAP, refer to Page 5. CAPITAL CITY BANK GROUP, INC. CONSOLIDATED STATEMENT OF OPERATIONS Unaudited 2023 2022 (Dollars in thousands, except per share data) First Quarter Fourth Quarter Third Quarter Second Quarter First Quarter INTEREST INCOME Loans, including Fees $ 34,880 $ 31,916 $ 27,761 $ 24,072 $ 22,133 Investment Securities 4,924 4,847 4,372 3,840 2,896 Federal Funds Sold and Interest Bearing Deposits 4,111 4,463 3,231 1,408 409 Total Interest Income 43,915 41,226 35,364 29,320 25,438 INTEREST EXPENSE Deposits 2,488 1,902 1,052 266 224 Short-Term Borrowings 461 690 536 343 192 Subordinated Notes Payable 571 522 443 370 317 Other Long-Term Borrowings 6 8 6 8 9 Total Interest Expense 3,526 3,122 2,037 987 742 Net Interest Income 40,389 38,104 33,327 28,333 24,696 Provision for Credit Losses 3,130 3,521 2,099 1,542 - Net Interest Income after Provision for Credit Losses 37,259 34,583 31,228 26,791 24,696 NONINTEREST INCOME Deposit Fees 5,239 5,536 5,947 5,447 5,191 Bank Card Fees 3,726 3,744 3,860 4,034 3,763 Wealth Management Fees 3,928 3,649 3,937 4,403 6,070 Mortgage Banking Revenues 6,995 5,497 7,116 9,065 8,946 Other 2,360 2,546 2,074 1,954 1,848 Total Noninterest Income 22,248 20,972 22,934 24,903 25,818 NONINTEREST EXPENSE Compensation 25,636 25,565 24,738 25,383 24,856 Occupancy, Net 6,762 6,253 6,153 6,075 6,093 Other 8,057 10,469 8,919 9,040 8,284 Total Noninterest Expense 40,455 42,287 39,810 40,498 39,233 OPERATING PROFIT 19,052 13,268 14,352 11,196 11,281 Income Tax Expense 4,133 2,599 3,074 2,177 2,235 Net Income 14,919 10,669 11,278 9,019 9,046 Pre-Tax Loss (Income) Attributable to Noncontrolling Interest 35 995 37 (306 ) (591 ) NET INCOME ATTRIBUTABLE TO

COMMON SHAREOWNERS$ 14,954 $ 11,664 $ 11,315 $ 8,713 $ 8,455 PER COMMON SHARE Basic Net Income $ 0.88 $ 0.69 $ 0.67 $ 0.51 $ 0.50 Diluted Net Income 0.88 0.68 0.67 0.51 0.50 Cash Dividend $ 0.18 $ 0.17 $ 0.17 $ 0.16 $ 0.16 AVERAGE SHARES Basic 17,016 16,963 16,960 16,949 16,931 Diluted 17,045 17,016 16,996 16,971 16,946 CAPITAL CITY BANK GROUP, INC. ALLOWANCE FOR CREDIT LOSSES ("ACL") AND CREDIT QUALITY Unaudited 2023 2022 (Dollars in thousands, except per share data) First Quarter Fourth Quarter Third Quarter Second Quarter First Quarter ACL - HELD FOR INVESTMENT LOANS Balance at Beginning of Period $ 24,736 $ 22,510 $ 21,281 $ 20,756 $ 21,606 Provision for Credit Losses 3,291 3,543 1,931 1,670 (79 ) Net Charge-Offs (Recoveries) 1,520 1,317 702 1,145 771 Balance at End of Period $ 26,507 $ 24,736 $ 22,510 $ 21,281 $ 20,756 As a % of Loans HFI 1.01 % 0.98 % 0.96 % 0.96 % 1.05 % As a % of Nonperforming Loans 577.63 % 1,076.89 % 934.53 % 677.57 % 760.83 % ACL - UNFUNDED COMMITMENTS Balance at Beginning of Period 2,989 $ 3,012 $ 2,853 $ 2,976 $ 2,897 Provision for Credit Losses (156 ) (23 ) 159 (123 ) 79 Balance at End of Period(1) 2,833 2,989 3,012 2,853 2,976 ACL - DEBT SECURITIES Provision for Credit Losses $ (5 ) $ 1 $ 9 $ (5 ) $ - CHARGE-OFFS Commercial, Financial and Agricultural $ 164 $ 129 $ 2 $ 1,104 $ 73 Real Estate - Commercial 120 88 1 - 266 Real Estate - Home Equity - 160 - - 33 Consumer 1,732 976 770 533 622 Overdrafts 634 720 989 660 780 Total Charge-Offs $ 2,650 $ 2,073 $ 1,762 $ 2,297 $ 1,774 RECOVERIES Commercial, Financial and Agricultural $ 95 $ 25 $ 58 $ 59 $ 165 Real Estate - Construction 1 - 2 - 8 Real Estate - Commercial 8 13 8 56 29 Real Estate - Residential 57 98 44 115 27 Real Estate - Home Equity 25 36 22 67 58 Consumer 571 175 260 453 183 Overdrafts 373 409 666 402 533 Total Recoveries $ 1,130 $ 756 $ 1,060 $ 1,152 $ 1,003 NET CHARGE-OFFS (RECOVERIES) $ 1,520 $ 1,317 $ 702 $ 1,145 $ 771 Net Charge-Offs as a % of Average Loans HFI(2) 0.24 % 0.21 % 0.12 % 0.22 % 0.16 % CREDIT QUALITY Nonaccruing Loans $ 4,589 $ 2,297 $ 2,409 $ 3,141 $ 2,728 Other Real Estate Owned 13 431 13 90 17 Total Nonperforming Assets ("NPAs") $ 4,602 $ 2,728 $ 2,422 $ 3,231 $ 2,745 Past Due Loans 30-89 Days $ 5,061 $ 7,829 $ 6,263 $ 3,554 $ 3,120 Past Due Loans 90 Days or More - - - - - Classified Loans 12,179 19,342 20,988 19,620 22,348 Nonperforming Loans as a % of Loans HFI 0.17 % 0.09 % 0.10 % 0.14 % 0.14 % NPAs as a % of Loans HFI and Other Real Estate 0.17 % 0.11 % 0.10 % 0.15 % 0.14 % NPAs as a % of Total Assets 0.10 % 0.06 % 0.06 % 0.07 % 0.06 % (1) Recorded in other liabilities (2) Annualized CAPITAL CITY BANK GROUP, INC. AVERAGE BALANCE AND INTEREST RATES Unaudited First Quarter 2023 Fourth Quarter 2022 Third Quarter 2022 Second Quarter 2022 First Quarter 2022 (Dollars in thousands) Average

BalanceInterest Average

RateAverage

BalanceInterest Average

RateAverage

BalanceInterest Average

RateAverage

BalanceInterest Average

RateAverage

BalanceInterest Average

RateASSETS: Loans Held for Sale $ 55,110 $ 644 4.74 % $ 42,910 $ 581 5.38 % $ 55,164 $ 486 4.82 % $ 52,860 711 4.44 % $ 43,004 $ 397 3.19 % Loans Held for Investment(1) 2,582,395 34,331 5.39 2,439,379 31,418 5.11 2,264,075 27,354 4.76 2,084,679 23,433 4.53 1,963,578 21,811 4.52 Investment Securities Taxable Investment Securities 1,061,372 4,912 1.86 1,078,265 4,835 1.78 1,117,789 4,359 1.55 1,142,269 3,834 1.34 1,056,736 2,889 1.10 Tax-Exempt Investment Securities(1) 2,840 17 2.36 2,827 17 2.36 2,939 17 2.30 2,488 10 1.73 2,409 10 1.60 Total Investment Securities 1,064,212 4,929 1.86 1,081,092 4,852 1.78 1,120,728 4,376 1.55 1,144,757 3,844 1.34 1,059,145 2,899 1.10 Federal Funds Sold and Interest Bearing Deposits 360,971 4,111 4.62 469,352 4,463 3.77 569,984 3,231 2.25 691,925 1,408 0.82 873,097 409 0.19 Total Earning Assets 4,062,688 $ 44,015 4.39 % 4,032,733 $ 41,314 4.07 % 4,009,951 $ 35,447 3.51 % 3,974,221 $ 29,396 2.97 % 3,938,824 $ 25,516 2.63 % Cash and Due From Banks 74,639 74,178 79,527 79,730 74,253 Allowance for Credit Losses (25,637 ) (22,596 ) (21,509 ) (20,984 ) (21,655 ) Other Assets 300,175 297,510 289,709 288,421 275,353 Total Assets $ 4,411,865 $ 4,381,825 $ 4,357,678 $ 4,321,388 $ 4,266,775 LIABILITIES: Interest Bearing Deposits NOW Accounts $ 1,228,928 $ 2,152 0.71 % $ 1,133,733 $ 1,725 0.60 % $ 1,016,475 $ 868 0.34 % $ 1,033,190 $ 120 0.05 % $ 1,079,906 $ 86 0.03 % Money Market Accounts 267,573 208 0.31 273,328 63 0.09 288,758 71 0.10 286,210 36 0.05 285,406 33 0.05 Savings Accounts 629,388 76 0.05 641,153 80 0.05 643,640 80 0.05 628,472 77 0.05 599,359 72 0.05 Time Deposits 89,675 52 0.24 92,385 34 0.15 94,073 33 0.14 95,132 33 0.14 97,054 33 0.14 Total Interest Bearing Deposits 2,215,564 2,488 0.46 % 2,140,599 1,902 0.35 % 2,042,946 1,052 0.20 % 2,043,004 266 0.05 % 2,061,725 224 0.04 % Short-Term Borrowings 47,109 461 3.97 % 50,844 690 5.38 % 46,679 536 4.56 % 31,782 343 4.33 % 32,353 192 2.40 % Subordinated Notes Payable 52,887 571 4.32 52,887 522 3.86 52,887 443 3.28 52,887 370 2.76 52,887 317 2.40 Other Long-Term Borrowings 480 6 4.80 530 8 4.80 580 6 4.74 722 8 4.54 833 9 4.49 Total Interest Bearing Liabilities 2,316,040 $ 3,526 0.62 % 2,244,860 $ 3,122 0.55 % 2,143,092 $ 2,037 0.38 % 2,128,395 $ 987 0.19 % 2,147,798 $ 742 0.14 % Noninterest Bearing Deposits 1,601,750 1,662,443 1,726,918 1,722,325 1,652,337 Other Liabilities 81,206 84,585 98,501 87,207 72,166 Total Liabilities 3,998,996 3,991,888 3,968,511 3,937,927 3,872,301 Temporary Equity 8,802 9,367 9,862 10,096 10,518 SHAREOWNERS' EQUITY: 404,067 380,570 379,305 373,365 383,956 Total Liabilities, Temporary Equity and Shareowners' Equity $ 4,411,865 $ 4,381,825 $ 4,357,678 $ 4,321,388 $ 4,266,775 Interest Rate Spread $ 40,489 3.77 % $ 38,192 3.52 % $ 33,410 3.13 % $ 28,409 2.78 % $ 24,774 2.49 % Interest Income and Rate Earned(1) 44,015 4.39 41,314 4.07 35,447 3.51 29,396 2.97 25,516 2.63 Interest Expense and Rate Paid(2) 3,526 0.35 3,122 0.31 2,037 0.20 987 0.10 742 0.08 Net Interest Margin $ 40,489 4.04 % $ 38,192 3.76 % $ 33,410 3.31 % $ 28,409 2.87 % $ 24,774 2.55 % (1) Interest and average rates are calculated on a tax-equivalent basis using a 21% Federal tax rate. (2) Rate calculated based on average earning assets. For Information Contact:

Jep Larkin

Executive Vice President and Chief Financial Officer

850.402.8450Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/eb26db8a-8d29-4e73-b20d-b8fdbba8bab3

https://www.globenewswire.com/NewsRoom/AttachmentNg/9c482b4a-94ca-4ecf-8c46-560f2e77353f

https://www.globenewswire.com/NewsRoom/AttachmentNg/5028b43a-7c88-471f-acaf-5db136b12fcf

https://www.globenewswire.com/NewsRoom/AttachmentNg/851f7c44-9fc9-4eb1-a844-b1ec546c23aa